We specialize in legacy planning, helping donors envision how they’ll transfer assets to their kids and favorite causes after they’re gone. But our conversations often start with how they can increase their generosity now while avoiding unnecessary tax. As we head into the end of the year, here are the top 5 ways we encourage donors to give at year-end:

Take Stock…of Your Stocks!

Even in a shaky economy, you may have stocks that are worth far more than you invested years ago. You can give a gift of appreciated stock to your favorite charity. You’ll avoid paying Capital Gains Tax on the appreciation, but the full market value of that stock will go to work for your favorite cause immediately. Contact your broker and indicate that you’d like to transfer stock to a charity. You’ll need their nonprofit tax ID number.

Make a QCD…ASAP.

Are you over 70 ½**? You can make a Qualified Charitable Distribution from your IRA to your favorite charity. If you don’t need your retirement fund income, it’ll allow you to give these pre-tax dollars. Depending on your income bracket, your charity could see 30% more impact than if you were to write a check or give cash (which is post-tax). Cha-ching!

**RMD starts at age 72

Yep, another acronym! At age 72, Americans are required to begin taking an income (aka Required Minimum Distribution) from their IRA. Anyone over 70 ½ can take advantage of the QCD provision, although if you’re 72 or better, you’ll NEED to take distributions, and they’re taxable. If you don’t need that income and prefer not to pay tax on it, this is a great way to give.

Contact your retirement fund custodian to initiate a QCD.

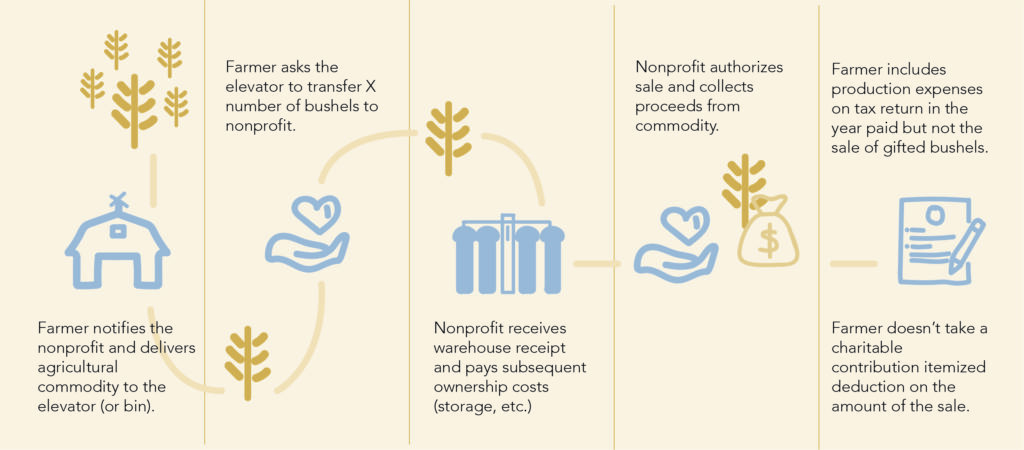

Have a Farm? Give Crops.

You can opt to donate crops to your favorite charity. There’s no charitable deduction here, but transfer the crop to the charity’s name before selling, and you’ll be able to exclude that from your annual income. Especially in a strong agricultural year like many regions are having this year, you can offset a higher income year and decrease the potential income taxes you’ll pay.

Fund a Donor Advised Fund

If a gift planning counselor could have a favorite giving tool, the Donor Advised Fund (DAF) would be mine, because it’s just so versatile. (We could write a whole post on the merits of a DAF, but that’s for another day!) DAF funding, up to 60% of your AGI, is tax-deductible in the year it’s funded. Then those funds grow with interest until you decide where and when to give them to your favorite causes. Think of it like your “charitable checkbook”: all the flexibility is in your court. It’s an amazing tool for year-to-year giving, but a DAF can also be paired with other estate planning tools. Like a mini-foundation without fees or maintenance, it can help instill generosity in your kids/heirs for generations to come. You can open a DAF in minutes and fund it with cash, securities, the sale of real estate, or pretty much any other asset.

Gift From Your Donor Advised Fund

Already have a DAF? If none of these other ideas are a great fit for you, and you have funds already set aside for charitable giving, make a grant or two in a way that doesn’t impact your cashflow!