No matter your age, stage of life, estate size, or budget, you can leave a meaningful legacy! Whether you need a quick review of a current legacy plan, have questions about charitable giving, or want to create a comprehensive, strategic plan from start-to-finish, we can help.

Not sure where to start? Connect with one of our legacy consultants. They can answer questions and give you a few things to think about and resources for developing your legacy plan.

Submit high-level information about your goals and estate. Then meet with a legacy consultant who will review your plan and suggest next steps.

During our signature program, a consultant will work with you from start-to-finish. You’ll get organized, assign key estate roles, understand and quantify your assets, visualize your options, and create a thoughtful, strategic plan.

Design a strategic legacy plan that takes care of your family and favorite causes.

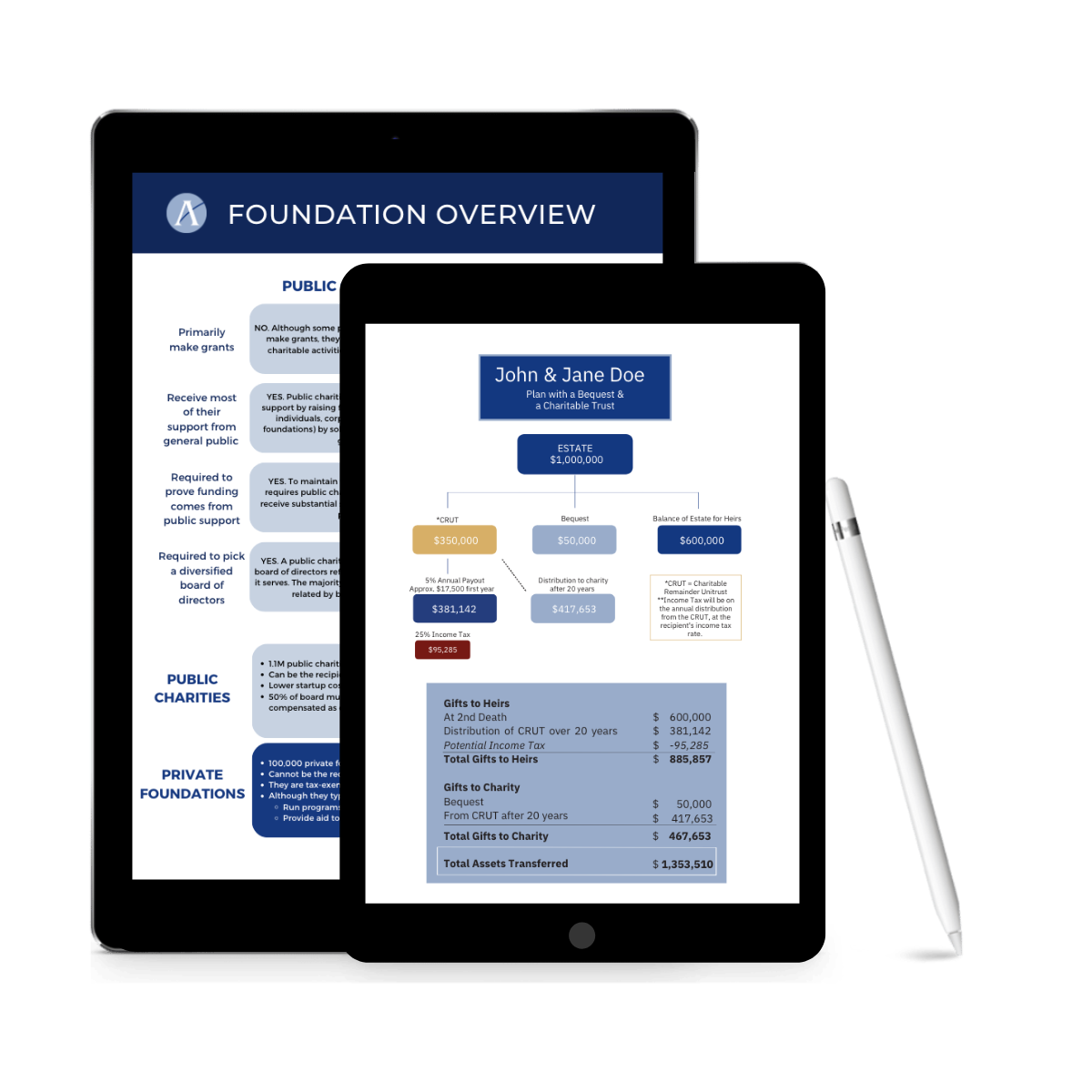

Receive customized illustrations showing your personalized estate options.

Create clear and organized estate documents that support your legacy and intentions.

Receive access to a knowledgeable consultant who will help guide you through the process.

Design a strategic legacy plan that takes care of your family and favorite causes.

Receive customized illustrations showing your personalized estate options.

Create clear and organized estate documents that support your legacy and intentions.

Receive access to a knowledgeable consultant who will help guide you through the process.

We could talk all day long about charitable giving tools, tax savings, and the ins and outs of our legacy planning program. But we love a good story. When Dan and Erika first came to Apex, they had a few main goals for their estate plan: they wanted to plan for an active retirement, empower their adult sons to live generously, and make a positive difference in their community. They just needed a little imagination–and peace of mind that their plans were in order. That’s where Apex came in!

Our full-length program usually includes 5-8 meetings. The more prepared and decisive you are, the quicker it’ll go! We’ll give you bite-sized tasks between meetings, and answer any questions you have along the way.

We wrote a whole blog post about this! But did you recently get married or divorced? Welcome a new child? Or maybe you had a loved one pass away, or a significant relationship has changed. All of these are great examples of times to revisit your plan! Even if nothing has changed in your family, we suggest to review your plan every 5 years to ensure it still does what you want it to.

Yes! If you have a team of professionals (estate attorney, financial advisor, insurance agent, etc.) we’ll work with them to get the most up-to-date information, with your permission. We’ll also act as the liaison between you and your team to ensure your plan is solid.

If you’re not sure where to start, we suggest scheduling a free 20-minute consultation. We’ll be able to get a general idea of where you’re at, answer questions, and help point you in the right direction. You can schedule that here!

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |