There are CRUTs and CRATs and DAFs and ILITs and QCDs, and while we’ve just scratched the surface of the many charitable giving tools out there, all the acronyms can seem like alphabet soup. If you’re just wanting an overview, here’s a crash course on the most common giving vehicles…and when they might be a good fit.

Cash or Check

Yep, these still work today! They’re probably the easiest way to support a nonprofit, because you just need your favorite device, some cash, or a checkbook and pen to make it happen. Though these are post- income tax funds we’re talking about here, you’ll still get a charitable deduction for the gift in the year you gave it–up to 100% of your Adjusted Gross Income (AGI)–so keep your receipt for tax time!

Donor-Advised Funds (DAF)

A donor-advised fund is administered by a public charity or foundation–and we often call it a “charitable checkbook.” You can set up a fund in minutes through Fidelity Charitable, community foundations, National Christian Foundation, Thrivent Charitable, WaterStone, or countless other organizations. Then, you can add to your fund with cash or appreciated assets. You receive an immediate tax deduction as if you were giving to any charity, but the funds are invested and grow tax-free until you decide how and when to grant them to your favorite charities. We’ve seen donors set up DAFs as a way to get kids more involved in charitable giving–and there are all sorts of ways to incorporate them into businesses or legacy plans. They can also function as a mini family foundation, of sorts, but without the cost or oversight of running a foundation. Grants can be made anonymously, too, which can be especially nice for higher net worth families or those who simply want their giving to remain private.

Charitable IRA Rollovers

If you’re over 70 ½, you can give to charity out of your traditional IRA, up to $100,000 per person per year (or $200,000 per couple, per year). A “rollover” or Qualified Charitable Distribution (QCD) can be made to any 501(c)3 organization. You’ll avoid paying income tax on those funds. And if you’re over 72, this may also help fulfill your Required Minimum Distribution (RMD)! To initiate a rollover, simply talk with the custodian of your IRA to have a check issued in the charity’s name. You’ll need the organization’s legal name, address, and federal tax ID number.

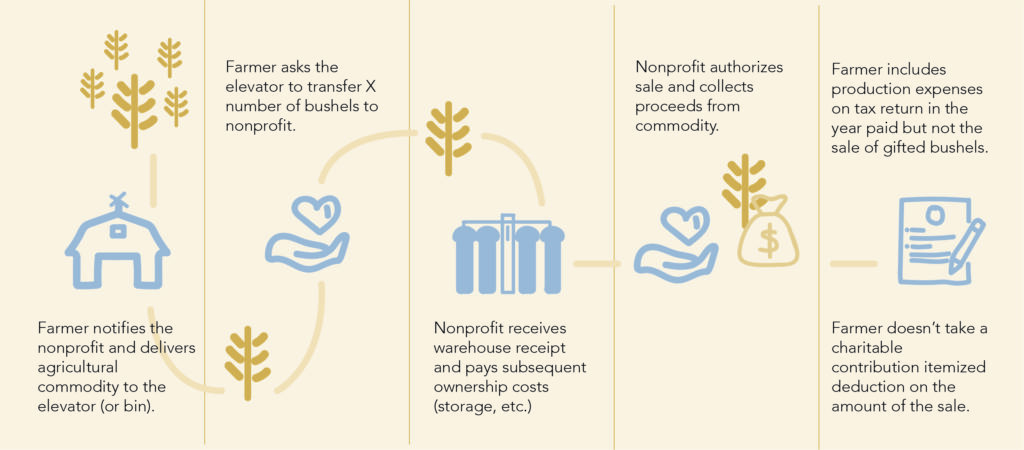

Gifts of Crop

They often say farmers are “land-rich, but cash-poor.” Gifting crops to a nonprofit or foundation is an amazing way to support your favorite cause(s) without affecting your day-to-day cash flow. Plus, you’re still able to deduct the cost of production as a business expense. A gift can be made anytime during the tax year. You won’t get a charitable tax deduction, but you’ll be decreasing your taxable income–so it’s still a big win.

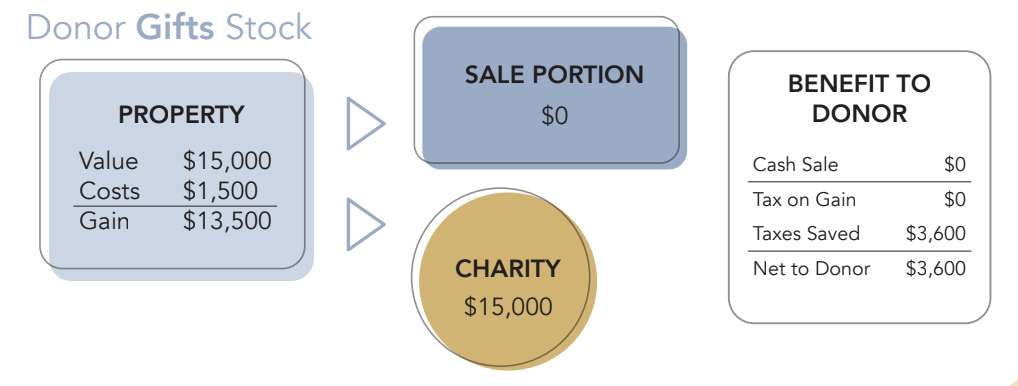

Gifts of Appreciated Assets (Think Cryptocurrency, Stocks, Securities, or Real Estate)

We could go on and on about this, but it’s a great idea to gift an appreciated asset (or a portion of it) to a charity instead of selling it outright and gifting the cash proceeds. Here’s why:

- You’ll receive a charitable tax deduction (and your charity will receive) the full appreciated, fair-market value of the asset.

- Meanwhile, you’ll avoid paying capital gains tax on the appreciation. If you’ve owned a piece of land for a long time, for instance, you could be on the hook for tax on the difference in value between when you bought it and now.

Here’s what this will look like:

Gift Annuities

These are becoming less common than they once were–because they involve some risk for a nonprofit–but they offer a stream of income to a donor/family from a nonprofit or foundation in return for a one-time gift. These can be a great option if you have appreciated assets (like business interests, real estate, stocks, securities, or collectibles) to sell later in life, because those can be directed to the nonprofit instead, in return for a predictable stream of income–for life. You can also create what’s called a deferred annuity, which means you can give your gift today, but wait to receive payouts until you or your loved one has reached a certain age. You might do this because the regular payment amounts are based on your age at the time of the first payment. (Here’s a gift annuity calculator, in case you want to play around with some numbers!).

Charitable Remainder Unitrust (CRUT)

We love charitable trusts around here. They are incredibly flexible, because they can be set up during life, creating a stream of income for you and/or your family with an incredible gift to charity at the end of the trust term. They can also give incredible tax benefits if funded with appreciated assets, because funding a charitable trust is the same as gifting outright to a specific charity, so the gift bypasses capital gains tax on the appreciation. CRUTs can also be set up to transfer assets into after your death–so your heirs can receive the tax benefit. There are other kinds of charitable trusts, too, but they have nuances. Give us a call or talk with your financial advisor or estate planning attorney to determine the right trust for your goals.