Dan and Erika (whose names and photo have been changed to protect their privacy) needed an estate plan. They had a few concrete goals, and as we walked through our signature program with them, we realized they’d be an amazing example of what the process looks like for most people. While every family is different, every estate is different, and every plan is different, we wanted to share their story so you can get a sense of what you’d expect when you partner with Apex. So without further ado, meet Dan and Erika!

They’d had “create a will” on their to-do list for years, and they’d recently heard a few statistics that made them feel more urgency around getting it done:

- The majority of Americans don’t have estate documents in place

- 60+% of Americans give to charity each year, but only 6% give out of their estate

- 91% of most people’s assets don’t become fully available for heirs or charity until they’ve passed away and no longer need the assets. In other words, they have a lot of illiquid assets like real estate, life insurance, retirement funds, etc.

Needless to say, they didn’t love these statistics! They had watched friends go through difficult situations settling their parents’ estates, and decided that this was the year to prioritize their own planning.

They began searching online for someone to draft a will for them, but they felt overwhelmed by all the decisions they’d have to make and unsure about how to bring together their passions and values, financial assets, and family dynamics into a long-term plan that was flexible enough to change with their situation–but also strategic enough to make a real difference.

The first step in legacy planning is naming your goals.

Dan and Erika have some things they’re passionate about. They knew they needed official documents–a will or trust of some kind, or maybe both. They had a financial advisor, but they didn’t really understand what they had to work with, or their unique opportunities. They were freaked out about words like “probate” and “power of attorney” and couldn’t figure out the connection between their long-term dreams and their financial picture today.

After some coffee and a preliminary conversation, here are the items that rose to the surface on their to-do list:

- Get organized and simplify things

- Retire to the family cabin someday

- Create great memories with loved ones

- Ensure their two sons are independent and kind, with their relationship remaining solid through the settlement of their parents’ estate

- Make a difference for Habitat for Humanity and a few of their other favorite charities

Family dynamics always play into legacy planning.

Dan and Erika have a great relationship with their two grown sons. But their sons are different–one is a little more frugal, and one lives a little more “freely” with his money–and they’re human.

One of the things they had to figure out is how much to give to their sons–and whether fair meant equal. Some of the questions we asked were:

- How much is enough for your sons to be financially independent?

- What do you want your sons to use their inheritance for?

- How much is too much? Is there a dollar amount you have in mind that’s at the top of what you think you want them to receive–and if they were to get more, would it actually hurt them?

- How do you want to structure their inheritance? Do you want to give money to your sons while you’re still alive to watch them enjoy it? Do you want them to receive a lump sum after you’re gone–or automatic, smaller payments over time? Should payments coincide with specific ages or life events?

One of the most shocking statistics we share with our clients is that statistics show that the vast majority of heirs spend their inheritance within 18 months. No matter the amount they receive, it’s gone quickly. It might be spent on worthwhile things, but between tax and paying down debt and sinking it into investments, their benefactors’ lasting financial legacy is gone.

Dan and Erika wanted to empower their sons to make wise financial decisions, and have the resources to live their lives well, but wanted to put some structure in place to make it as positive and long-lasting an inheritance as possible.

Another major piece of legacy planning is understanding your assets: the risk and opportunities they present.

We put together a rough list of what makes up Dan and Erika’s estate. We talked about their liquid assets–their cash, savings and checking accounts–as well as longer term assets like their home, family cabin, vehicles, retirement and investment funds, and life insurance. They were shocked when they saw the total number they had to work with.

Then we started to talk about which assets would trigger tax when their sons inherit them. We often divide someone’s estate into two buckets. “Qualified assets” are the things that are pre-tax and will incur income tax for heirs. This is often what people want to eliminate or mitigate, if they can. The balance of the estate, then, is the assets that can go to heirs tax-free from the estate someday.

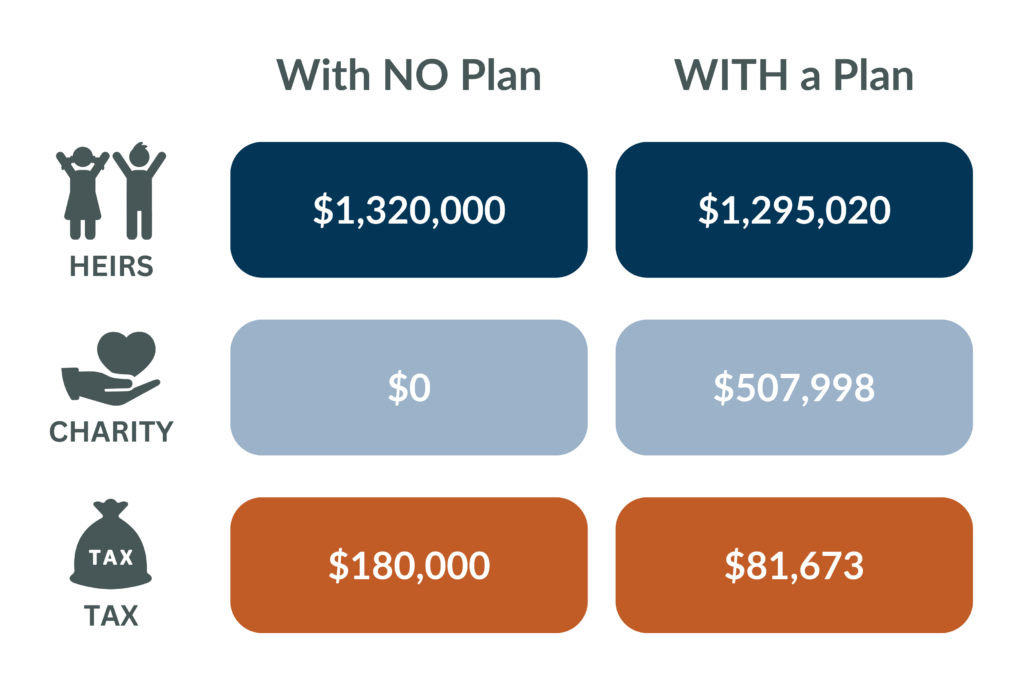

Illustrations allow people to envision their legacy in a practical way–and compare different scenarios.

We created a number of different illustrations that took Dan and Erika’s actual estate numbers and showed what would happen with different combinations of spending levels, life expectancies, gifts to heirs, charitable gifts, and financial planning tools incorporated. We use a special software that projects things like tax and market growth, so it gives a detailed picture of what actual payouts would be to heirs and charity down the road.

Let’s do a little comparison to show what we mean:

You’ll see that the change was dramatic between what their estate was able to do before they had an actual plan–the default of what would happen in probate, without estate documents in place–and what they’re going to be able to do now.

Their legacy plan is comprehensive, and we walked with them start-to-finish.

Over the course of our relationship with Dan and Erika, we met several times to talk through different components of their plan. Besides giving them peace of mind about their financial picture long-term, here’s what we achieved together:

- We helped them organize their important documents, logins, etc. They know where their things are–and the right people have access to them.

- We helped them identify estate representatives. They selected executors/personal representatives, trustees, and powers of attorney for healthcare and financial matters. Those people know they’ve been named and have the information they need to be successful.

- We talked them through how to put the family cabin into a trust to preserve and maintain it.

- We made a plan for family travel–and talked through their long-term retirement income. They have a few exciting family vacations in the works that their sons will never forget.

- They set up an endowment through Habitat for Humanity so they can give more now and fully fund a project after they’ve passed away.

- We created a plan for involving their kids in charitable giving. They’re working with their favorite charities to share their intentions and be part of the organizations’ visions now, so that someday, their boys can be a part of carrying on that legacy of generosity.

- They limited and strategically timed their sons’ inheritance so that it provided financial support without enabling poor decisions.

- We worked with an estate attorney, financial advisor, trust company, and development officers to create estate documents in support for their plans.