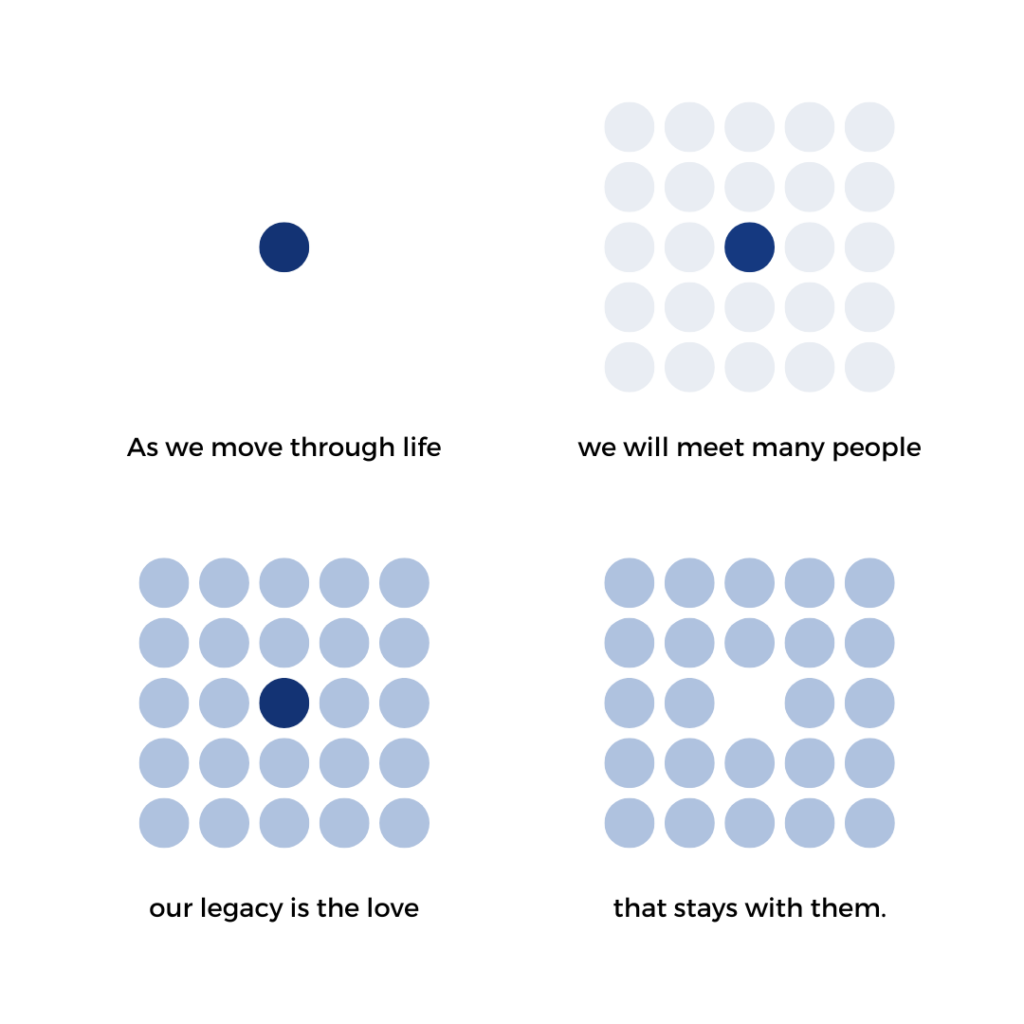

The Venn Diagram overlap between internet memes and legacy planning is pretty small. That said, we saw a graphic like this on Instagram the other day from @newhappyco, and thought it perfectly summed up what we’re about:

Yes, we also talk about family dynamics and assets and financial needs and goals. We discuss tactics and charitable tools and which professionals to pull in when. But it all boils down to this: what’s the essence of the person/family that we’re trying to intentionally preserve and plan around?

A lot of what we talk about involves what’ll happen after that person or couple or family has passed away, and sometimes there’s grief involved in thinking about the future in that way. But legacy planning also brings tremendous peace of mind, and frees up our clients to live with more intentionality and vigor for the many years they have left of their lives! They get a clearer picture of their estate and finances, and put plans in place for worst-case scenarios–by designating healthcare Powers of Attorney and setting up healthcare directives, shoring up beneficiary designations in case something happens to them unexpectedly, and even purchasing additional life insurance, if needed.

But once those things are in place, and our clients have given some thought to the type of people they want to be–and the softer side of their legacy–they begin to live differently!

Here are our favorite ways to get more intentional about the legacy you’re leaving. Best of all, you can start now!

Write a Legacy Letter

Those who’ve been following Apex for a while know that this is something we regularly encourage our clients to do. If you’re intimidated by the thought of sitting down with loved ones and sharing your heart verbally, put it in writing! Start a notebook filled with memories and Our Legacy Letter blog post is one of our most-read posts, and for good reason. It costs nothing to put a Legacy Letter together, but these words can mean the world to your loved ones.

Capture Your Story

Have unique items in your home? Make sure you’ve documented them somewhere. Do you know your family’s history, or do you have important details about key life milestones, places, or relationships that you want to make sure are shared? Create a video of your story, record audio of you sharing some of these things, or start a binder. Teach your kids how to make your grandma’s lasagna or how to use your dad’s antique woodworking tools. There’s no “right” way to capture these things for your loved ones, but the important thing is that you do it in a way that’s authentic and meaningful for your family.

Give Financially to Your Heirs

One of the top goals our clients mention is that they want to make sure their kids or loved ones are cared for financially. There are countless ways to make that happen through an estate plan, and we talk in great detail about strategically timing disbursements and making sure an inheritance will have the most positive impact on loved ones as possible. And that may look different from child to child–or change significantly over time.

A core question that helps us flesh out what a plan will look like is: “what impact do you want your financial gifts to have on your heirs?” We sometimes ask, “how much is too much?” We look at projections of what heirs are likely to inherit, and when, and determine if parameters need to be set up to time payments to coincide with major life events or expenses. In this conversation, sometimes clients realize that what’s important to them is empowering their heirs to live generously, pay down debt, travel more regularly, etc. There’s no reason that has to wait until after someone has passed away! In fact, if clients live to a normal life expectancy, it’s possible their kids won’t see any kind of inheritance until they’re well beyond middle-age themselves, and the impact of an inheritance might be significantly less–or just different–than it would have been if they’d inherited funds earlier in life.

If you have wiggle room in your estate, and you know you’re set for retirement, as of this year you can gift up to $17,000 to any one person, per year, without penalty. And if you’re married, you and your spouse can each gift up to $17,000 per year to anyone in your family. Giving to your heirs now may enable you to see the impact of your gifts on their lives: you’ll see them pay down their mortgage, give more to their favorite causes, or simply have more wiggle room in their financial situation.

Make Memories

Again, if your legacy is what your loved ones are left with after you’re gone, memories might be one of the most incredible gifts you can give them! We’ve had clients fund once-in-a-lifetime trips for their family to explore their genealogy. We’ve had others set aside funds so their extended family could go to a specific summer camp each year together–or for grandkids to attend a private school or university that meant a lot to their family. Rent the convertible and take the road trip with your son! Surprise your daughter with her dream wedding dress, or show up at a niece’s piano recital in a different state. When they’re done with intentionality, all of these things make up beautiful parts of a personal legacy–and clients tell us they are far more meaningful than any financial legacy could possibly be.

Give a Major Gift to Charity

There are so many amazing ways to give to charity–including non-cash options that might have major tax benefits without impacting your day-to-day cash flow. Even if your goal is to fund a scholarship at your alma mater through a charitable trust–and that won’t fully happen for decades after you’re gone–there’s nothing preventing you from starting that fund now and funding it as you’re able! Wouldn’t it be awesome to get to know the students receiving the scholarship that’s named after you? Or if you’re selling a business, downsizing your home, or making other major financial decisions, consider incorporating a charitable gift into that process.